Aplos has everything you need in one place for streamlined nonprofit and church management. Specialized in the unique financial challenges nonprofits face, our platform experts have helped thousands of nonprofits, and we do it well. Our experts will make sure all information nonprofit bookkeeping services is present and accounted for. Fortunately, nonprofit professionals don’t have to worry about your financial information if you choose FreshBooks. Over the last 13 years, Jitasa’s tax specialists have completed thousands of tax filings for nonprofits of all shapes and sizes.

Want More Helpful Articles About Running a Business?

While bookkeepers make sure the small pieces fit correctly into place, accountants use those small pieces to draw much more significant and broader conclusions about a company’s finances. Bookkeepers may start working for a small business to gain experience and then go back to school for a degree in accounting or finance. Enrolling in one of the best online bookkeeping classes is a smart way for those interested in this career to bolster their existing financial knowledge. With bookkeepers, there are a lot of minutiae involved, and keen attention to detail is paramount. Accountants, on the other hand, tend to use the bookkeeper’s inputs to create financial statements and periodically review and analyze the financial information recorded by bookkeepers.

Accounting ServicesExclusively for Nonprofits

Since nonprofit organizations don’t center on profit but on a nonprofit mission, they have different bookkeeping practices. While the basic bookkeeping principles may apply in both cases, certain seemingly small details make significant differences in how a nonprofit’s finances are done. Many accounting software programs allow you to generate financial statements automatically, such as a statement of financial position. This reduces the possibility of errors and guarantees reliability and accuracy. Of course, you can always generate financial statements manually, but this takes a lot of time and skill. Depending on the size of your nonprofit organization and the number of transactions, it may be wise to do bank reconciliations once a month.

Setting up a New System

It allows users to track income and expenses, invoice donors or clients and run financial reports. Unlike some of its competitors, Wave doesn’t charge for features like invoicing or financial tracking. Managing money at a nonprofit involves more than just recording income and expenses. Additionally, many nonprofits have multiple revenue streams, such as donations, grants, membership dues and fundraising events.

Nonprofit bookkeeping is a nonnegotiable task—it just has to be done. You can either assign this task to one of your staff members or trust a professional to handle it. Your message has been received and we’ll be reviewing your request shortly. In the meantime, schedule a meeting with us and we’ll be in touch soon.

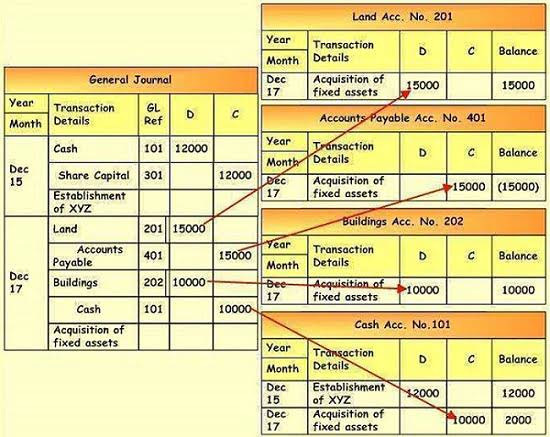

Accounts Payable

- Bookkeepers are commonly responsible for recording journal entries and conducting bank reconciliations.

- Enrolling in one of the best online bookkeeping classes is a smart way for those interested in this career to bolster their existing financial knowledge.

- First, find out which considered software offers a free trial or a version you can use to try the software before buying.

- For a long-term career, accounting offers much more upward mobility and income potential.

- A nonprofit’s statement of cash flow tracks a nonprofit organization’s cash and financial health.

- Absolutely, we can have regular meetings so you can advise on the reporting you need and you can access your bookkeeping online at any time to pull reports and review the books.

Keep in mind, not all items on the list may apply to your organization. As nonprofit CPAs, we can prepare and file all of your tax returns. When you partner with us, you’ll pay a flat monthly fee (no hourly billing or overages).

If they want to maintain this status, they need to do accurate bookkeeping. No one knows your nonprofit better than you do, which is why you should hire a professional bookkeeper to get your records in order and leave the decision-making up to your organization’s leaders. And, if you need further advice, an experienced bookkeeper can give you their perspective on your budget.

If you want to become a bookkeeper for a nonprofit, try looking at internships that could help you learn more about the processes. You may want to visit the National Council of Nonprofits to learn more. You should also hire a financial officer or a treasurer who knows how to do bookkeeping for a nonprofit and is familiar with specialized accounting software. The basis for an accurate bookkeeping https://www.bookstime.com/blog/accounting-for-marketing-agencies and accounting system is recording all financial transactions. This information will be used later to produce financial statements (and report your financial information to the IRS), so you should thoroughly and accurately detail each transaction your nonprofit makes. All of our bookkeepers are US-based, Quickbooks ProAdvisor certified, and experts in nonprofit accounting.

The education required to be competitive in the field is greater, but the payoff down the road can be considerably higher. Depending on the city, job, and company, you can expect to earn between $64,000 and $115,000 as an accountant in 2024, with the lower salaries typical for accountants just starting out in their careers. Additionally, when working for larger firms, the benefits can be a large draw, including retirement plans, significant paid vacation days, telecommuting opportunities, and a robust health insurance package. While accounting can be a lucrative long-term career, most accountants, unlike corporate attorneys or investment bankers, do not command huge salaries during the first few years.