So instead of putting the cash in the bank, they use it to invest in the other companies for higher profit. You need to make an entry to record your purchase because your basis ($40K) is not the seller’s basis ($100). If you don’t make an entry, you likely will eventually end up with a gain of $39,900 ($40K – $100) that you don’t have because you didn’t record your basis of $40K.

How to account for shares in a double entry accounting system [closed]

Two common accountsin the equity section of the balance sheet are used when issuingstock—Common Stock and Additional Paid-in Capital from CommonStock. Common Stock consists of the par value of all shares ofcommon stock issued. Additional paid-in capitalfrom common stock consists of the excess of the proceeds receivedfrom the issuance of the stock over the stock’s par value. When acompany has more than one class of stock, it usually keeps aseparate additional paid-in capital account for each class. Thetransaction will require a debit to the Paid-in Capital fromTreasury Stock account to the extent of the balance. If thetransaction requires a debit greater than the balance in thePaid-in Capital account, any additional difference between the costof the treasury stock and its selling price is recorded as areduction of the Retained Earnings account as a debit.

Recording Stock Transactions

The split causes the number of shares outstanding to increase by four times to 240,000 shares (4 × 60,000), and the par value to decline to one-fourth of its original value, to $0.125 per share ($0.50 ÷ 4). No change occurs to the dollar amount of any general ledger account. The company plans to issue most of the shares in exchange for cash, and other shares in exchange for kitchen equipment provided to the corporation by one of the new investors.

OpenStax

If the company issue debt to the market, they have obligation to pay for the annual interest. Moreover, on the maturity date, the issuer has to pay back the principal amount. Her Quickbook’s Book and her financial statement both was recorded her shares $100 for 100 shares . PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Which means if you look at the balance sheet of McDonalds, you will not see how many bags of French fries are remaining at their storage facility, you will only see the total value at cost basis.

Popular Contents $type=blogging$count=6$author=hide$comment=hide$label=hide$date=hide$hide=home$s=0

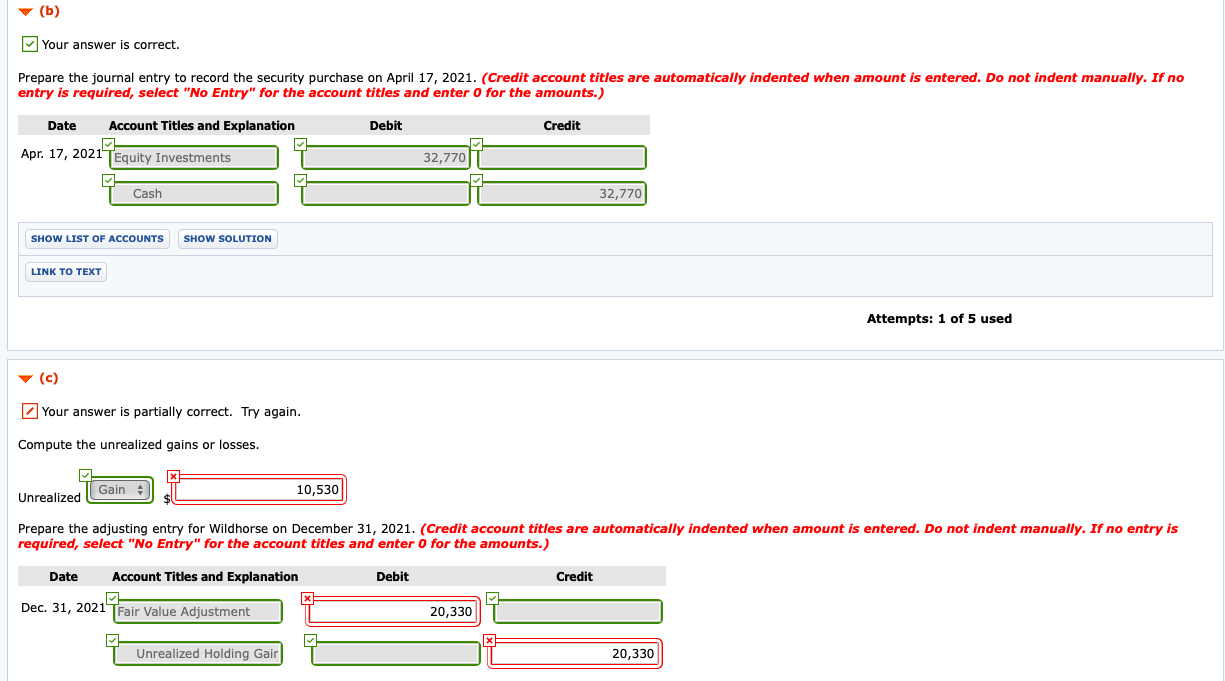

Therefore, if the shares of Bayless are worth $28,000 at December 31, Year One, Valente must adjust the reported value from $25,000 to $28,000 by reporting a gain. To see the effects on the balance sheet, it is helpful to compare the stockholders’ equity section of the balance sheet before and after the small stock dividend. For corporations, there are several reasons to consider sharing some of their earnings with investors in the form of dividends. Many investors view a dividend payment as a sign of a company’s financial health and are more likely to purchase its stock. In addition, corporations use dividends as a marketing tool to remind investors that their stock is a profit generator. Chad and Rick have successfully incorporated La Cantina and areready to issue common stock to themselves and the newly recruitedinvestors.

- A gain is reported if more than $25,000 is received while a loss results if the shares are sold for less than $25,000.

- According to The MotleyFool, the Walt DisneyCompany bought back 74 million shares in 2016alone.

- Treasury stock transactions have no effect on the number of shares authorized or issued.

- Duratech will pay the market price of thestock at $25 per share times the 800 shares it purchased, for atotal cost of $20,000.

Company purchase shares of other entities, they have to record increases in marketable security and cash paid. For example, the company can use the cost method of accounting for the ownership less than 20%, however when it has ownership from 20% to 50% it needs to use the equity method to record the revenue and dividend it earns from the investee company. On the other hand, if the company holds more than 50% ownership, it will become the parent company and the investee company will become its subsidiary company.

At the time, you probably were just excited for the additional funds. I have created an account which corresponds to my account with a share broker. how to fill out and file form w When I pay the broker money, I do a transfer from my bank account to the broker’s account, which leaves a cash balance with the broker.

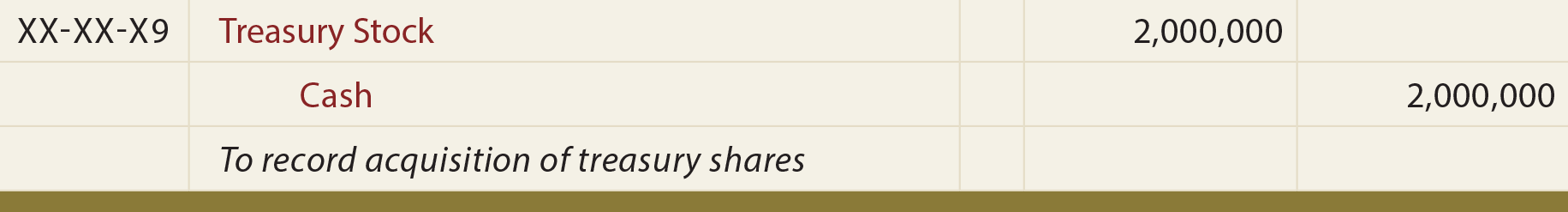

Treasury stock is the stock that the company repurchases its own shares back from the market. Likewise, the company needs to record the purchase of treasury stock as a contra account to stockholders’ equity on the balance sheet. Companies frequently find that they are holding excess cash not needed at the moment for operating purposes. Traditional savings accounts or money market funds offer very low returns for this money. Company officials often seek a greater profit by using surplus cash to buy the ownership shares of other organizations.