The benefit that results from this type of cost structure is that, if sales increase, the company’s profits will also increase correspondingly. Analyzing operating leverage helps managers assess the impact of changes in sales on the level of operating profits (EBIT) of the enterprise. Higher DOL means higher operating profits (positive DOL), and negative DOL means operating loss.

Operating Leverage Formula: How to Calculate Operating Leverage

The degree of operating leverage (DOL) measures how much change in income we can expect as a response to a change in sales. In other words, the numerical value of this ratio shows how susceptible the company’s earnings before interest and taxes are to its sales. The higher the degree of operating leverage (DOL), the more sensitive a company’s earnings before interest and taxes (EBIT) are to changes in sales, assuming all other variables remain constant. The DOL ratio helps analysts determine what the impact of any change in sales will be on the company’s earnings. On the other hand, a low DOL suggests that the company has a low proportion of fixed operating costs compared to its variable operating costs. This means that it uses less fixed assets to support its core business while sustaining a lower gross margin.

How can DOL affect decision-making?

Therefore, the dividend payable to preference shareholders is regarded as a fixed charge when calculating financial leverage. These calculators are important because as critical as it is to know how the business is doing, the price you are paying for a part of the company is also important. We will discuss each of those situations because it is crucial to understand how to interpret it as much as it is to know the operating leverage factor figure. You shouldn’t use it to compare a software company to a manufacturing company because their business models are completely different. However, high operating leverage also creates greater risk in some contexts.

Operating Leverage Calculator

The average tax applicable to the company is 30% and corporate dividend tax is 20%. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. For comparability, we’ll now take a look at a consulting firm with a low DOL.

High DOL indicates that a small percentage change in sales can lead to a significant change in operating income. This tells you that, for a 10% increase in sales volume, ABC will experience a 25% increase in operating profit (10% x 2.5). The current sales price and sales volume is also sufficient for both covering ABC’s $3,000,000 fixed costs and turning a profit as a result of the $10 per unit contribution margin. If fixed costs are higher in proportion to variable costs, a company will generate a high operating leverage ratio and the firm will generate a larger profit from each incremental sale.

Formula

Variable costs decreased from $20mm to $13mm, in-line with the decline in revenue, yet the impact it has on the operating margin is minimal relative to the largest fixed cost outflow (the $100mm). From Year 1 to Year 5, the operating margin of our example company fell from 40.0% to a mere 13.8%, which is attributable to $100 million fixed costs per year. The direct cost of manufacturing one unit of that product was $2.50, which we’ll multiply by the number of units sold, as we did for revenue. Upon multiplying the $2.50 cost per unit by the 10mm units sold, we get $25mm as the variable cost. In our example, we are going to assess a company with a high DOL under three different scenarios of units sold (the sales volume metric).

More sensitive operating leverage is considered riskier since it implies that current profit margins are less secure moving into the future. That indicates to us that this company might have huge variable costs relative to its sales. Similarly, we can conclude the same by realizing how little the operating leverage ratio is, at only 0.02. If a company has low operating leverage (i.e., greater variable costs), each additional dollar of revenue can potentially generate less profit as costs increase in proportion to the increased revenue.

The reason operating leverage is an essential metric to track is because the relationship between fixed and variable costs can significantly influence a company’s scalability and profitability. This means that they are fixed up to a certain sales volume, varying to higher levels when production and sales volume increase. DOL helps investors assess the potential risks and rewards of a company’s cost structure, giving insights into how changes in sales might impact profitability. For example, mining businesses have the up-front expense of highly specialized equipment.

By contrast, a retailer such as Walmart demonstrates relatively low operating leverage. The company has fairly low levels of fixed costs, while its variable costs are large. For each product sale that Walmart rings in, the company has to pay for the supply of that product.

- To lower your DOL, consider reducing fixed costs, increasing variable costs, or adjusting your cost structure to make it more flexible in response to sales changes.

- Although you need to be careful when looking at operating leverage, it can tell you a lot about a company and its future profitability, and the level of risk it offers to investors.

- Many small businesses have this type of cost structure, and it is defined as the change in earnings for a given change in sales.

- The DOL ratio assists analysts in determining the impact of any change in sales on company earnings or profit.

- The contribution margin represents the percentage of revenue remaining after deducting just the variable costs, while the operating margin is the percentage of revenue left after subtracting out both variable and fixed costs.

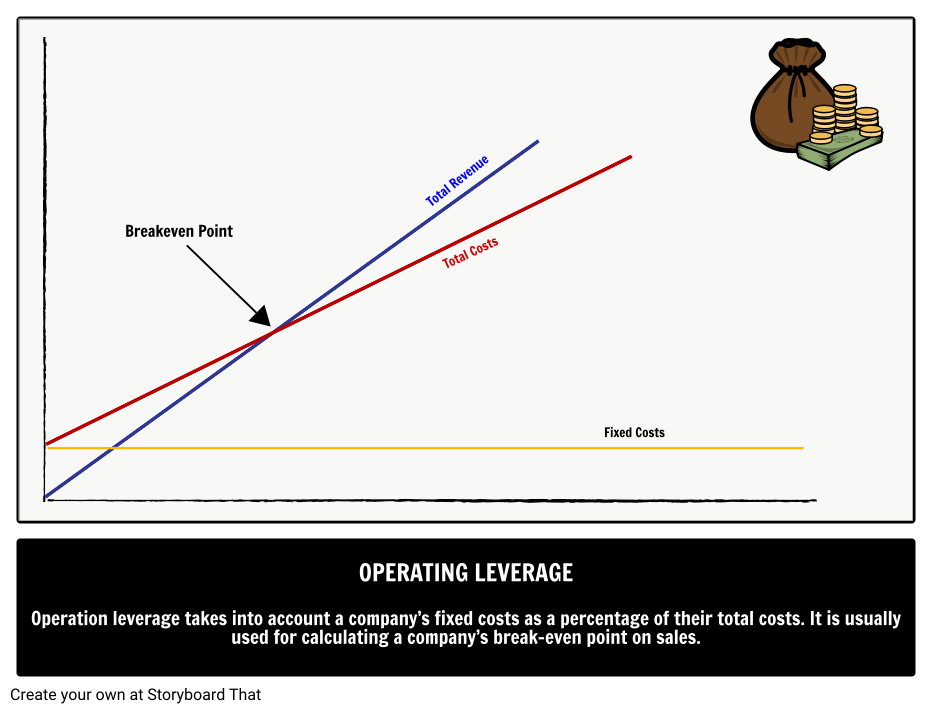

Consider a company with fixed costs of $500,000, variable costs of $2 per unit, and selling price of $10 per unit. When sales increase, fixed assets such as property, plant, and equipment (PP&E) can be more productive without additional expenses, further boosting profit margins. The more fixed costs there are, the more sales a company must generate in order to reach its break-even point, which is when a company’s revenue is equivalent to the sum of its total costs. Running a business incurs a lot of costs, and not all these costs are variable.

Airlines have the expense of purchasing and maintaining their fleet of airplanes. Once they have covered their fixed costs, they have the ability to increase their operating income considerably with higher sales depreciation schedule for computers output. On the other hand, low sales will not allow them to cover their fixed costs. John’s Software is a leading software business, which mostly incurs fixed costs for upfront development and marketing.